Turing Token (TUIT)

TUIT serves as the core value medium of the Turing M ecosystem, supporting the operation and growth of the entire ecosystem through multi-functional design and mechanisms, embodying the principle of Token-Equity Parity and co-creating platform value with its holders.

TUIT Utilities

Reflection of Platform Value

Through transaction fee revenue, deflation, and commissions, the data growth of Turing Market is reflected in the token’s value. Holding TUIT is equivalent to holding shares, allowing holders to share in the platform’s value growth.

DAO Governance

Grants token holders the right to participate in ecosystem decision-making and proposal submissions, realizing decentralized autonomy and enhancing Turing M’s transparency, fairness, and community cohesion.

Token Dividends

TUIT’s dividend mechanism is a key manifestation of the Token-Equity Parity Principle, providing holding income to users who subscribe to the token, incentivizing long-term holding and ecosystem participation with **daily dividend**.

There are two types of dividends:

- Lock-up Dividends: Earnings generated from subscribed tokens under the lock-up status.

- Staking Dividends: Earnings generated from staking tokens that have been unlocked.

daily dividends are accrued daily on locked and staked tokens.- Locked Dividends: Daily accrued dividends

- In the smart contract, unlocking is incrementally released on a 30-day cycle, so the number of tokens participating in dividend calculation decreases correspondingly every 30 days

- The quantity of locked tokens participating in daily dividend calculation is determined by the amount of tokens still locked for the next 30-day cycle

- Users can additionally withdraw this part of the unlocked tokens to their wallet and participate in dividends through staking

- Staking Dividends: Daily accrued dividends

- The platform will launch different staking dividend products with varying staking cycles from time to time

- Users can stake their available tokens in their wallet to participate

- Staking dividends are accrued daily. Users become entitled to actual dividend distribution after staking for 30 full days. If a user unstakes before completing 30 days, the accrued dividends will be allocated to the platform’s buyback fund account.

- After the staking order expires

- The staking order will not be automatically renewed upon maturity; users can withdraw the tokens of the expired staking order themselves

- Users can withdraw the staking dividends accumulated during the staking period

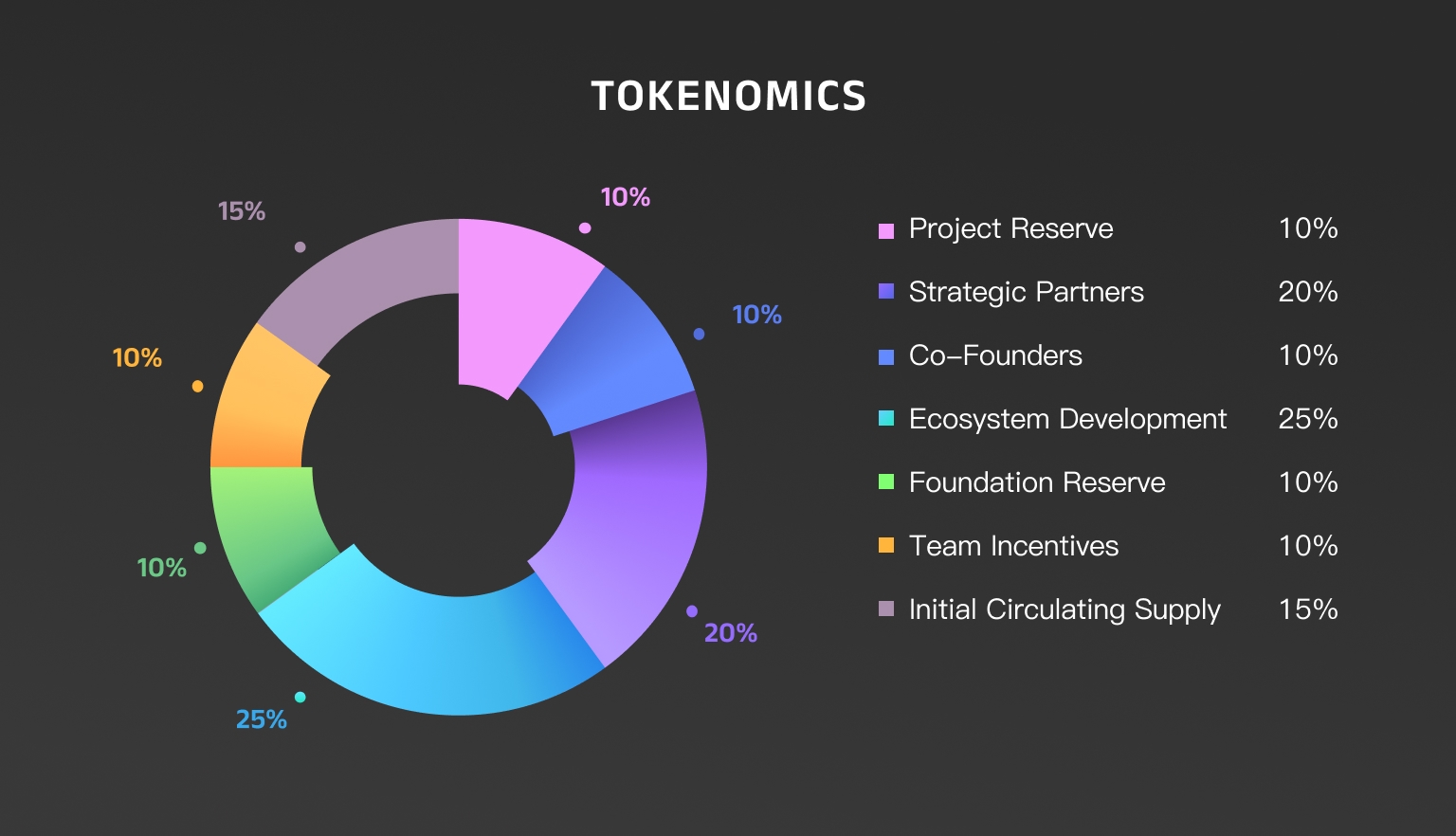

Token Allocation

- Token Name: TUIT

- Total Supply: 1,000,000,000 TUIT

- Initial Price: $0.10

months are all based on a 30-day cycle, not calendar months.- Turing M strictly interpret according to the calculation logic defined in the smart contract code as accurately as possible.

- In the smart contract, cycles are precisely calculated based on the number of seconds corresponding to 30 days.

Token Issuance Overview

- Project Team (10%): Reserved for core project operations and development. Tokens are subject to a 12 months lock-up, followed by a vesting schedule with incremental monthly releases from months 1 to 36.

- Co-Founders (10%): Allocated to seed round co-founders based on investment amount. Entitled to 31%–55% referral commissions, subject to internal or strategic partner approval. Tokens are subject to a 12 months lock-up, followed by a vesting schedule with incremental monthly releases from months 1 to 36. Designed to support offline team expansion.

- Strategic Partners (20%): Allocated to strategic partners in the seed round. Tokens are subject to a 12 months lock-up, followed by a vesting schedule with incremental monthly releases from months 1 to 36. Strategic partners receive 60% commission share and may join the Strategic Decision Committee via vetting, receiving top-tier governance and proposal rights in Turing DAO.

- Ecosystem Development (25%): Reserved for community operations, events, airdrops, user incentives, and marketing initiatives to foster healthy ecosystem growth.

- Foundation Reserve (10%): Allocated to support the operations of the Turing M Foundation, funding DAO governance and public interest projects.

- Team Incentives (10%): Allocated to reward core team members and advisors for their long-term contributions. Tokens are subject to a 12 months lock-up, followed by a vesting schedule with incremental monthly releases from months 1 to 36.

- Initial Circulation (15%): Allocated to liquidity pools on DEXs (e.g., TUIT/USDT) to ensure deep initial liquidity and low slippage, supporting the mainnet launch.

Issuance Objects

Strategic Partners

Strategic partners are institutions or individuals who participate in the seed round of the Turing M project by subscribing to TUIT tokens. They are committed to the long-term development of the Turing M ecosystem and enjoy the highest rights of governance, profit-sharing, and strategic decision-making within the ecosystem. Strategic partners are not merely financial supporters but co-builders of the Turing M ecosystem, leveraging their resources, influence, and expertise to help position Turing Market as a leader in the Web3 event trading area.

Eligibility

To be a Strategic Partner, candidates must meet at least one of the following criteria:

- Possess strong market expansion capabilities by recruiting Co-Founders to grow Turing M's user base and drive trading volume and community engagement on Turing Market;

- Have access to Web3 ecosystem resources, such as renowned public chains or crypto influencers, to promote synergy between Turing M and existing projects, expanding ecosystem influence;

- Demonstrate strong promotional capabilities, including community influence or brand communication skills, to broaden Turing M's reach in both Web3 and traditional markets and attract widespread user participation;

- Have the ability to introduce funding into the Turing M ecosystem to support platform operations, technology development, and marketing efforts.

Participation qualifications and detailed execution terms, including subscription amounts and token allocation ratios, will be confirmed through offline negotiations. The Turing M team will arrange meetings and offline communications for further discussion.

Benefits

As core participants of the Turing M ecosystem, Strategic Partners are entitled to the following benefits to encourage deep involvement and foster ecosystem prosperity:

gas token.

To avoid gas token waste, a single withdrawal amount must exceed 10 USDT.

Subsequent references to self-withdrawal will not be additionally explained.- Initiating proposals to expand event markets: eligibility to propose new event prediction categories;

- Market expansion decisions: voting on the addition of new event prediction categories;

- Operational strategies: participating in decisions on Turing M's major future marketing plans and direction;

- Token listing plans: contributing to decisions on TUIT’s listing strategy on exchanges.

Lock-up Restrictions

Smart Contract Lock-up: Purchased TUIT tokens are locked via smart contracts and released incrementally after the lock-up period through linear vesting. Once unlocked, tokens remain eligible for staking to earn dividends and revenue sharing.

Co-Founders

Co-Founders are early investors and promoters of Turing M, supporting platform development through capital contributions and promotional activities, especially playing an important role in user growth and community building. Co-founders can apply to be Agent Partners upon purchasing TUIT. Based on their token holdings, they are eligible to earn 31%–55% in referral commission (refer to the appendix for specific thresholds).

Qualifications

To become a Co-Founder, you must meet the following qualification threshold:

- A certain level of market development ability;

- To expand the Turing M ecosystem’s user base by recruiting Public Agents and users;

- driving Turing Market’s trading volume and community engagement.

Rights and Benefits

As core participants in the Turing M ecosystem, Co-Founders are granted the following rights to encourage their deep involvement and to promote ecosystem prosperity:

| Amount | Applicable Commission Rate | Amount | Applicable Commission Rate |

|---|---|---|---|

| 1,000 | 31% | 90,000 | 44% |

| 10,000 | 32% | 100,000 | 45% |

| 15,000 | 33% | 110,000 | 46% |

| 20,000 | 34% | 120,000 | 47% |

| 25,000 | 35% | 130,000 | 48% |

| 30,000 | 36% | 140,000 | 49% |

| 35,000 | 37% | 150,000 | 50% |

| 40,000 | 38% | 160,000 | 51% |

| 45,000 | 39% | 170,000 | 52% |

| 50,000 | 40% | 180,000 | 53% |

| 60,000 | 41% | 190,000 | 54% |

| 70,000 | 42% | 200,000 | 55% |

| 80,000 | 43% |

This activity is limited to the first round, during which Agent Partners can apply for commission rates. The content of the activity may be changed or canceled in the future. For details, please refer to the official website announcement.

| Amount | Applicable Commission Rate | Amount | Applicable Commission Rate |

|---|---|---|---|

| 2,000 | 31% | 180,000 | 44% |

| 20,000 | 32% | 200,000 | 45% |

| 30,000 | 33% | 220,000 | 46% |

| 40,000 | 34% | 240,000 | 47% |

| 50,000 | 35% | 260,000 | 48% |

| 60,000 | 36% | 280,000 | 49% |

| 70,000 | 37% | 300,000 | 50% |

| 80,000 | 38% | 320,000 | 51% |

| 90,000 | 39% | 340,000 | 52% |

| 100,000 | 40% | 360,000 | 53% |

| 120,000 | 41% | 380,000 | 54% |

| 140,000 | 42% | 400,000 | 55% |

| 160,000 | 43% |

This activity is limited to the second round, during which Agent Partners can apply for commission rates. The content of the activity may be changed or canceled in the future. For details, please refer to the official website announcement.

- Initiate event market expansion proposals: the qualification to submit proposals to add new types of event prediction trades.

- Event market expansion decisions: vote to decide which new event prediction trades to add.

- Operational strategies: participate in deciding major future marketing plans and directions of Turing M.

**Time and Amount Limited** Discount

TUIT token subscription discount: those who purchase TUIT tokens within the limited period will enjoy a discount to incentivize subscription.

Below is the first round subscription discount table for Co-Founders:

| Amount (USDT) | Expected Quantity |

|---|---|

| 1,000 | 11,000 TUIT |

| 2,000 | 24,000 TUIT |

| 3,000 | 39,096 TUIT |

| 4,000 | 56,240 TUIT |

| 5,000 | 75,500 TUIT |

| 6,000 | 91,872 TUIT |

| 7,000 | 108,668 TUIT |

| 8,000 | 125,888 TUIT |

| 9,000 | 143,532 TUIT |

| 10,000 | 161,600 TUIT |

| 11,000 | 180,136 TUIT |

| 12,000 | 199,104 TUIT |

| 13,000 | 218,504 TUIT |

This discount is only for the first round subscription. The content of the discount may be changed or canceled in the future. For details, please refer to the official website announcement.

Below is the second round subscription discount table for Co-Founders:

| Amount (USDT) | Expected Quantity |

|---|---|

| 2,000 | 22,000 TUIT |

| 4,000 | 48,000 TUIT |

| 6,000 | 75,684 TUIT |

| 8,000 | 102,576 TUIT |

| 10,000 | 130,300 TUIT |

| 12,000 | 158,904 TUIT |

| 14,000 | 188,356 TUIT |

| 16,000 | 218,688 TUIT |

| 18,000 | 249,912 TUIT |

| 20,000 | 282,000 TUIT |

| 22,000 | 315,040 TUIT |

| 24,000 | 348,960 TUIT |

| 26,000 | 383,76 TUIT |

| 27,000 | 401,490 TUIT |

This discount is only for the second round subscription. The content of the discount may be changed or canceled in the future. For details, please refer to the official website announcement.

Lock-up Restriction

Smart contract lock-up: The purchased TUIT will be locked through a smart contract and will be linearly incremental released after the lock-up period. After unlocking, it can continue to participate in staking and enjoy dividends and revenue sharing.

Public Agents

The Public Agent is an early promoter of Turing M, who already has a certain fan base or community group (such as KOLs and community leaders). Becoming a Public Agent does not require holding TUIT.

Qualifications

Users with certain potential promotion audiences (such as KOLs, leaders of community groups).

Rights and Benefits

As an important promotion channel of the Turing M ecosystem, to incentivize their participation and promote ecosystem prosperity, Public Agents approved by an Agency Partner or the platform have the following rights and benefits:

When Public Agents conduct promotion and generate an effective number of users, they can receive corresponding TUIT tokens. After staking, they can upgrade to obtain the corresponding rebate rate, dividends, and revenue sharing.

- Initiate event market expansion proposals: qualification to submit new event prediction trading categories;

- Event market expansion decisions: voting to decide the addition of new event prediction trading categories;

- Operational strategy: participate in deciding Turing M’s future major marketing plans and directions (requires staking more than 1,000 tokens).

Circulation Management

To maintain market confidence stability and preserve the long-term value of TUIT tokens, Turing M will implement circulation management for TUIT, releasing tokens in batches to ensure market cap stability. The following explains the locking and unlocking periods:

Lock-up Period

The lock-up period refers to the restricted period during which TUIT tokens, after being allocated to roles (such as Strategic Partners), may not be freely traded or transferred. The purpose is to stabilize the token market and support the long-term development of the Turing Market ecosystem.

According to the token allocation plan, the lock-up period is set to 12 months (12 * 30 days), calculated from the date of token distribution. After the lock-up period ends, TUIT tokens will be linearly unlocked on a monthly basis, fully releasing over 36 months.

Lock-up Dividend

Lock-up dividends are the dividends received by holders of locked tokens during the lock-up period, automatically distributed daily via smart contracts.

The following table shows the token allocation ratios for each role, lock-up and unlocking rules, and whether they are entitled to lock-up dividend rights:

| Role | Allocation | Total Quantity | Lock-up Period | Lock-up & Vesting Rule | Staking Dividends During Lock-up |

|---|---|---|---|---|---|

| Project Team | 10% | 100,000,000 | 12 months | 12-month lock-up; then vesting with incremental monthly releases over 36 months | Not eligible |

| Strategic Partners | 20% | 200,000,000 | 12 months | 12-month lock-up; then vesting with incremental monthly releases over 36 months | Eligible |

| Team Incentives | 10% | 100,000,000 | 12 months | 12-month lock-up; then vesting with incremental monthly releases over 36 months | Not eligible |

| Co-Founders | 10% | 100,000,000 | 12 months | 12-month lock-up; then vesting with incremental monthly releases over 36 months | Eligible |

| Ecosystem Development | 25% | 250,000,000 | No Lock-up | No Lock-up | Eligible (if staked) |

| Initial Circulation Supply | 15% | 150,000,000 | No Lock-up | No Lock-up | Eligible (if staked) |

| Public Interest Foundation | 10% | 100,000,000 | 12 months | 12-month lock-up; then vesting with incremental monthly releases over 36 months | Not eligible |

Unlocking Period

Except for Ecosystem Development and Initial Circulation Supply, all other roles’ TUIT will be locked during the first year. During the lock-up period, TUIT cannot be transferred or traded. After the lock-up period ends, TUIT will be gradually released monthly in a linear increasing manner to ensure a stable growth in market circulation volume.

Taking 1,000,000 TUIT tokens as an example, the table below shows the monthly linear incremental release data calculation.

| Time | Current Month Unlock Amount | Still Locked |

|---|---|---|

| The 1st 30 days | 1501.50 | 998498.50 |

| The 2nd 30 days | 3003.00 | 995495.50 |

| The 3rd 30 days | 4504.50 | 990990.99 |

| The 4th 30 days | 6006.01 | 984984.98 |

| The 5th 30 days | 7507.51 | 977477.48 |

| The 6th 30 days | 9009.01 | 968468.47 |

| The 7th 30 days | 10510.51 | 957957.96 |

| The 8th 30 days | 12012.01 | 945945.95 |

| The 9th 30 days | 13513.51 | 932432.43 |

| The 10th 30 days | 15015.02 | 917417.42 |

| The 11th 30 days | 16516.52 | 900900.90 |

| The 12th 30 days | 18018.02 | 882882.88 |

| The 13th 30 days | 19519.52 | 863363.36 |

| The 14th 30 days | 21021.02 | 842342.34 |

| The 15th 30 days | 22522.52 | 819819.82 |

| The 16th 30 days | 24024.02 | 795795.80 |

| The 17th 30 days | 25525.53 | 770270.27 |

| The 18th 30 days | 27027.03 | 743243.24 |

| The 19th 30 days | 28528.53 | 714714.71 |

| The 20th 30 days | 30030.03 | 684684.68 |

| The 21th 30 days | 31531.53 | 653153.15 |

| The 22th 30 days | 33033.03 | 620120.12 |

| The 23th 30 days | 34534.53 | 585585.59 |

| The 24th 30 days | 36036.04 | 549549.55 |

| The 25th 30 days | 37537.54 | 512012.01 |

| The 26th 30 days | 39039.04 | 472972.97 |

| The 27th 30 days | 40540.54 | 432432.43 |

| The 28th 30 days | 42042.04 | 390390.39 |

| The 29th 30 days | 43543.54 | 346846.85 |

| The 30th 30 days | 45045.05 | 301801.80 |

| The 31th 30 days | 46546.55 | 255255.26 |

| The 32th 30 days | 48048.05 | 207207.21 |

| The 33th 30 days | 49549.55 | 157657.66 |

| The 34th 30 days | 51051.05 | 106606.61 |

| The 35th 30 days | 52552.55 | 54054.05 |

| The 36th 30 days | 54054.05 | 0.00 |

For TUIT unlocked by the project party, team incentives, strategic partners, and co-founders (regardless of whether the user has withdrawn it to their wallet), they will no longer enjoy dividend rights. Users can choose to stake them to regain dividend rights and additionally obtain possible staking interest rights. In addition, even if they do not withdraw when due, they can still withdraw to their personal wallet later. After withdrawal, they can stake or use them to deduct transaction fees in trading.

Staking Mechanism

Staking means users deposit TUIT from their wallet into the Token Unlocker smart contract as collateral to obtain corresponding dividend rights and potential staking interest rights. All unlocked TUIT withdrawn to the user’s wallet can be chosen for staking. Users must select the staking duration. The platform will carry out different staking interest activities at different times.

Applicable Participants for Staking

Turing Market allows all users to participate in staking, aiming to incentivize long-term holding of TUIT tokens and enhance ecosystem stability. This mechanism promotes long-term value support for the token by providing dividend income to holders. Additionally, users participating in staking during staking interest activity can receive extra TUIT interest rewards in addition to USDT dividends. If there is no staking interest activity at the time of staking, they will only enjoy USDT dividends.

If users do not withdraw after the staking period ends, they can still choose to withdraw to their personal wallet later or continue staking.

Below are the definitions of the staking dividend and interest mechanisms:

- Dividend Eligible Participants: All users holding unlocked TUIT tokens

- Dividend Conditions: The user must stake their available TUIT tokens for at least 30 days.

- Dividend Distribution: According to the Turing Market’s transaction fee income distribution rules, dividends are calculated daily and distributed monthly based on the proportion of tokens held.

Staking users must complete 30 days of staking before they can enjoy the daily dividends accrued during the staking period. If the user cancels the staking before 30 days are completed, the dividends calculated during this period will be allocated to the dedicated liquidity pool address.

- Interest Eligible Participants: All staking users.

- Interest Conditions: Users must hold the stake until the end of the staking term to be eligible for the interest.

- The Interest Rate: The interest rate is determined by the staking period selected by users.

| Period | Token Based(Annualized Rate) |

|---|---|

| 180-day | 6% |

| 270-day | 12% |

| 365-day | 18% |

This activity is only for the first round. In the future, the activity content may be modified or cancelled. Please refer to the official website announcements for details.